-

-

-

From the Seller Info section: "Remember, prospective buyers will be 'comparison shopping' and keenly aware of subtle differences in houses for sale in the area. Be sure to tell your listing broker why yours is special - from any home remodeling to afternoon winter sunshine."

READ MORE -

-

From the Marketing Plan section: "If your agent is not a good negotiator, not only will you not get the best deal, often your house won't get sold at all. We take pride in this aspect of our business experience."

READ MORE -

-

From the Home Inspectors section: "Even if the home inspection is to be for informational purposes only, it is your duty to get a solid general knowledge about the property you are about to purchase. To date, the state of Maryland does not require a formal home inspection. The more you know the better."

READ MORE -

-

From the General Contractors section:

"Always make sure their license is active and in good standing. Make sure that the contractor you hire is fully qualified to do the job and not working under someone else's license as an apprentice or subcontractor."

READ MORE

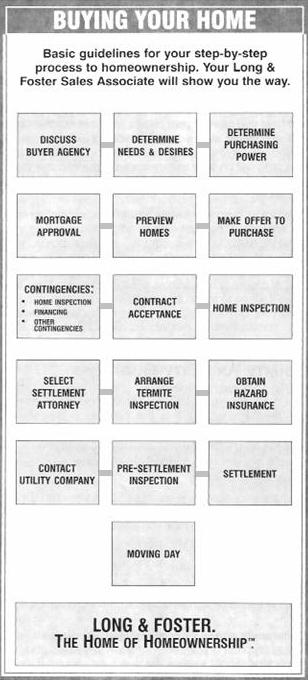

BUYER INFORMATION

HOW MUCH HOUSE?

House hunting begins at home - with planning. The first step toward buying a house is to sit down. Before you grab the road maps and hit the streets, you need to do a little planning. We call it "pre-qualifying." Simply, it's determining how much house you can afford to buy. Knowing your affordable price range will bring your house-hunting into focus. Many lenders, for a small "up-front" fee, will send out all of the required verification and pre-approve you for a mortgage, allowing you the opportunity to negotiate as a cash buyer.

How much

house you can afford to buy depends on

two things: how much you can afford for the monthly housing payment,

and how much you can invest in the down payment. Monthly payments

include principal and interest on the mortgage loan, and property taxes

and insurance against fire and other hazards. These four costs are

often abbreviated "P.I.T.I.". For some buyers and lenders, monthly

housing costs may also include homeowners association dues, condominium

fees, and mortgage insurance.

How much

house you can afford to buy depends on

two things: how much you can afford for the monthly housing payment,

and how much you can invest in the down payment. Monthly payments

include principal and interest on the mortgage loan, and property taxes

and insurance against fire and other hazards. These four costs are

often abbreviated "P.I.T.I.". For some buyers and lenders, monthly

housing costs may also include homeowners association dues, condominium

fees, and mortgage insurance.

QUALIFYING

In today's market, an "affordable" home is not so much determined by sales price as it is by the financing which translates that price into a monthly payment. A house hunter's first step is to set a housing budget, then go shopping for the house (price) and payments (P.I.T.I.) that fit that budget.

Even though there are many ways to qualify to buy a home, make sure the monthly payment makes sense for you. How large a payment you qualify for will depend upon a variety of factors. These factors include credit history, size of down payment, and length of employment. Everyone's circumstances are different.

HOW MUCH HOUSE CAN I AFFORD?

The key items are the size of the down payment, interest rate, monthly property fees, and the amount of the mortgage. The down payment might be zero in the case of VA-backed mortgages. A down payment of 20% or more on a conventional loan will eliminate the need for mortgage insurance. Your Long & Foster Sales Associate can be very helpful to you in determining just how much house you can afford.

SOURCES FOR YOUR DOWN PAYMENT

The obvious source of money for your down payment is either your savings or the proceeds from the sale of a home you already own, but there are some other not so obvious sources. In recent years, for example, "parent power" has taken some new twists for first-time buyers.

Home Equity Loan. Parents often have considerable equity built up in their own homes - and many are tapping that asset through home equity loans to make a gift to the youngsters. Ask your tax advisor for current information. Often lenders will require a "gift letter" to verify that parents don't expect repayment.

Shared Equity/Profit Sharing. In return for providing a part of the down payment, the parents (or another investor) share in the "profit" or net equity of the house when the homeowners eventually sell it.

Life Insurance. If you have built up a cash value on your life insurance policy over the years, you may be able to borrow from your insurance company up to the amount of this accumulated cash value. Often, they will even ask a more favorable interest rate than would be asked for other types of loans.

Stocks and Bonds. If you feel the market doesn't favor selling your stocks and bonds now, you may be able to secure a bank loan using your portfolio as security.

Company Profit Sharing or Savings Plan. Look into the possibility of withdrawing what you have in your profit sharing or savings plan account or borrowing against it, if your company has these programs.

MORTGAGE INSURANCE CAN REDUCE DOWN PAYMENT

If you obtain a conventional loan, you may make a down payment of 5% or less. Through the lender, you will be required to buy private mortgage insurance (PMI). This insurance provides protection for the lender in case of default, allowing the lender to approve a larger loan amount.

Mortgage insurance offers a variety of payment options. You may make an initial payment at closing and monthly payments with the house payment. You may make only an initial payment or only monthly payments. You may even increase your interest rate and have the lender pay the insurance. Be sure to ask your lender for a comparison of the benefits of each of these plans.

ONE CAUTION

The larger the down payment, the less money you need to borrow. This means a lower monthly payment. However, remember that in addition to your down payment and monthly payments, you will need money to pay for closing costs, moving, appliances, household setup, a reserve for family emergencies, and other miscellaneous items. So don't plan to put your last penny down on the closing table.

MORE MORTGAGE HELP

New types of mortgages exist featuring help for first-time buyers and flexible terms for current home owners. These help home buyers to "afford more house" and to buy sooner by expanding qualification criteria.

© 2022

Zona Teal. All rights reserved.

Portions © 2009 Long & Foster Real Estate, Inc. Used with permission.